Reports

Use reports to help you to understand your tax and transactions.

For Vertex for e-Commerce users, the service provides the necessary tax reports to help you to file your tax return. The tax reports are easily accessed via the dashboard.

The following reports are available:

| Report | Description |

|---|---|

| Settlement Report | Provides an overview of transactions. |

| Detailed Settlement Report | Provides a more detailed view of transactions. |

| B2B Reports | Provides details about B2B transactions for countries where this is required for digital goods. |

| Merchant VAT and Fee report | Provides an overview of VAT and fees. |

| Refund reports | Provides an overview of refunds. |

Note

For EU businesses, Vertex also creates a VIES (EC sales list) and a domestic report.

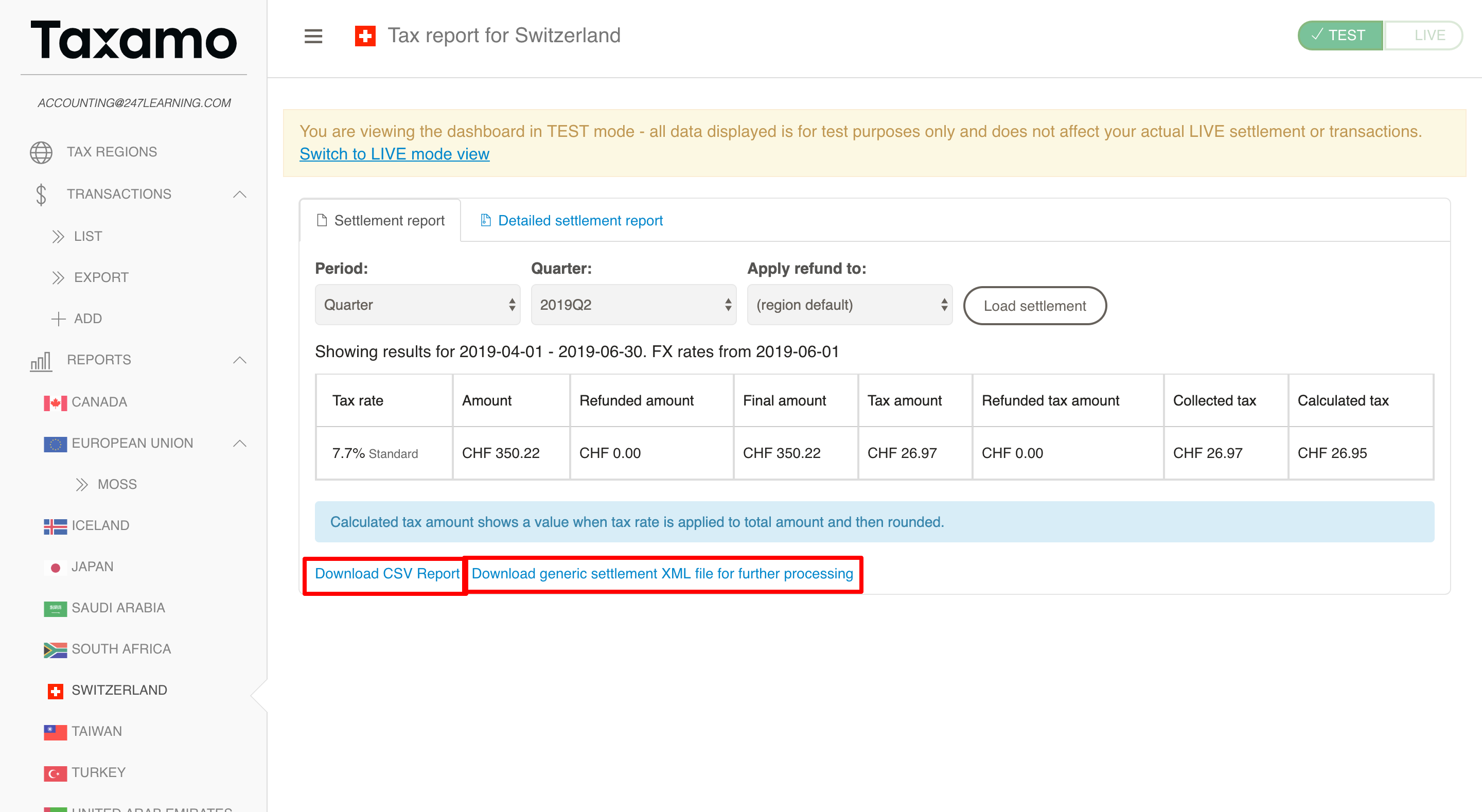

Downloading a Report

Tax reports are available in 2 formats, CSV and XML format:

- To download the data contained in the settlement report on the screen in CSV format, click Download CSV Report.

- To download the data contained in the settlement report on the screen in XML format, click Download generic settlement XML file for further processing.

These options are shown in the following screenshot:

Refund Reports

To access the refund report section, go to the Refunds in the Merchant Portal.

There are now two options under Refunds: Summary and Detailed report. Refunds reports are exported in .csv file format.

Vertex provides a refund report which includes a summary of all refunds for any of the tax regions which you have enabled in your account. This report provides a list of all refunds made. The report includes the following information:

- Date of the refund(s)

- Order date

- Tax country

- Refund tax amount

- Total refund amount

- Refund currency

- Transaction key

- Reason for the refund

- Transaction external unique ID

Updated 10 months ago