Integrated Vertex Validator

Read about how you can use Vertex Validator with one of the other products to help you to process B2B transactions.

Overview

You can also use Vertex Validator as part of Vertex for e-Commerce, Vertex Advantage Plus or Taxamo Assure. This is known as an integrated deployment of validator.

For this type of deployment, you use the same API requests that you use for the rest of your integration. To integrate it, you use the buyer_tax_number field.

Prerequisite Settings

Before you can use the service, you need to enable the Tax calculation setting for that region or country in the UI. You can review the supported countries in the Validation Type per Country topic.

Settings are also available to configure the behavior for validation. See the B2B Settings section of the Country Settings topic for more information.

API Integration

You can validate a Tax ID as part of a transaction using the Store transaction request.

For example, the following JSON specifies an ID from a business based in the Czech Republic in the "buyer_tax_number": "CZ12345678" field.

{

"transaction": {

"buyer_name": "John Smith",

"currency_code": "EUR",

"status":"N",

"transaction_lines": [

{

"custom_id": "Test",

"amount": 100,

"quantity": 1

}

],

"buyer_tax_number": "CZ12345678",

"order_date": null,

"billing_country_code": "CZ",

"force_country_code": "CZ"

}

}

VAT Status Caching

After a tax number is validated, its status can be stored in the cache. See VAT Status Cache.

Configuring CAPTCHA Validation

Some countries require additional validation such as CAPTCHAs. See Configuring CAPTCHA Validation.

Validating Multiple Tax IDs for Canada

Some Canadian provinces require that you validate more than one Tax ID simultaneously. See Validating Multiple Tax IDs for Canada.

Transaction Processing

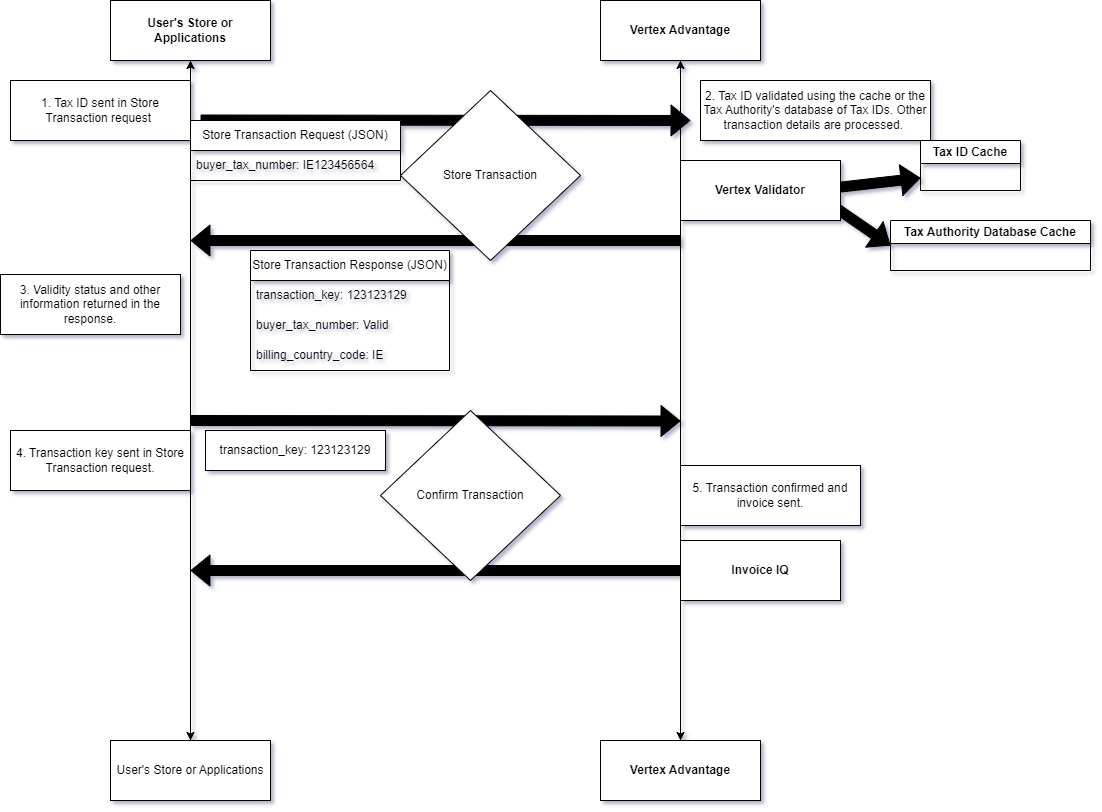

The following diagram shows a simplified example process flow with the Store transaction and Confirm transaction requests. This example uses Vertex for e-Commerce but it could also be Vertex Advantage Plus or Taxamo Assure.

Integrated Validator Processing

The steps are as follows:

- A Tax ID is sent to Vertex for e-Commerce in the

buyer_tax_numberfield in a Store transaction request. - The Tax ID is vaidated.

- The Store Transaction contains a

transaction_keyfield that is later used to confirm the transaction. as well as information about the validation. - The key is returned in Confirm transaction request. The invoice is sent.

- The transaction is confirmed and invoice is sent.

Post Transaction Processing

If the Tax ID is not valid, the system behavior can differ depending on your country settings and your Tax ID Cache settings. Sometimes, it can reject the transaction. In some cases, it can treat the transaction as a Business-to-Customer (B2C) transaction. See VAT Status Cache

Addresses

If the Tax ID is valid, the service might return the address of the business as per the authority's records. For example:

"invoice_address": {

"freeform_address": "Prague St. 314",

"country": "CZ"

}

This value overwrites the value that is used in the following fields:

transaction.invoice_addresstransaction.invoice_address.freeform_addresstransaction.invoice_address.countrytransaction.buyer_name

Redacted Responses

In some cases, the tax authority does not reveal this information so it may not be returned. In these responses, the tax authority can redact specific information. See Redacted Responses.

Updated 9 months ago