Country Settings

There are a couple of settings that can be specified per country. To access these, open the dashboard and go to INTERNATIONAL VAT/GST and click on a country from the list. You will see something like this:

Taxation Settings

The following taxation settings are available:

| Checkbox | Description |

|---|---|

| Tax Calculation - Enabled | If this is selected, the service will calculate tax for this country. This setting is required to enable the product's services for the specified country. |

| Tax Calculation - Disabled | If this is selected, the service will not calculate tax for this country. If this setting is selected, none of the product's features will work in this country. |

| Seller - My Company | If you select this checkbox, the seller is liable for all transactions. Taxamo cannot be deemed as the liable party. |

| Taxamo | If you select this checkbox, Taxamo can be deemed as liable for qualifying transactions. This is only relevant for Taxamo Assure by Vertex customers. |

| Threshold Monitoring - Disabled | If you select this checkbox, threshold monitoring is turned off for this country. |

To enable tax calculation for the country, click the Enabled checkbox. After you do so, the Direct Taxation settings are displayed.

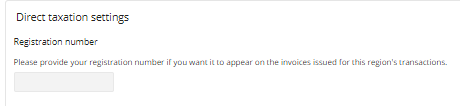

Direct Taxation Settings

You can use the Direct Taxation settings to specify a registration number that is used on invoices and to choose settings for reverse charges and B2B transaction processing. For example:

Settings are grouped in the following sections:

Registration number

You can enter your Tax ID in the provided box. it will be displayed on invoices that are issued for this region. For example:

Reverse Charge Settings

The following settings are available for the business number (Tax ID) that is used for reverse transactions:

| Checkbox | Use |

|---|---|

| Apply the same business number as for other transactions in this region | If selected, the same Tax ID is used for reverse charges and other transactions. |

| Set the business number to be blank when the transaction has reverse charge applied | If selected, the Tax ID field will have no value in it for reverse charge transactions. |

| Use the value provided for reverse charge transactions in this region: | If selected, the value that you specify here will be used in the Tax ID field for reverse charge transactions. |

B2B Settings

The following settings are available for B2B transactions:

| Checkbox | Use |

|---|---|

| Treat transactions with an {Country Tax ID} as B2C and apply tax | If selected, transactions that have a valid Tax ID like a VAT ID, will be treated as Business-to-Customer (B2C) transactions. The applicable B2C tax rate is applied. |

| Check syntax of {Country Tax ID}. If valid do not apply tax, flag these transactions for later review | If selected, transactions whose Tax ID's syntax is valid are flagged for later review. |

| Check syntax of {Country Tax ID}. If valid do not apply tax | If selected, only the syntax of Tax IDs. If it is valid, no tax is applied. |

| Verify {Country Tax ID} against the {Regional Database} system. If valid do not apply tax | If selected, the Tax ID is verified against the database of valid IDs. If the ID is valid, no tax is applied. |

| Block transactions with a {Country Tax ID} | If this checkbox is selected and a valid Tax ID is detected, these transactions are blocked. If an invalid ID is detected, the transaction is treated as expected per your settings. |

B2B Timeout Settings

The following settings are available for B2B Tax ID validation:

| Checkbox | Use |

|---|---|

| Custom {Country} B2B lookup timeout | If selected, the custom timeout value that you specify here will be used for validation requests. The value must be between 10 and 30,000 milliseconds. |

Country Variations for B2B

The verification and validation can vary per country. See Validation Type per Country.

Updated about 1 year ago