Detailed Settlement Report

The Detailed Settlement report offers an in-depth overview of settlements.

To access it, open the Dashboard and click the country you wan to report on and click the Detailed settlement report tab.

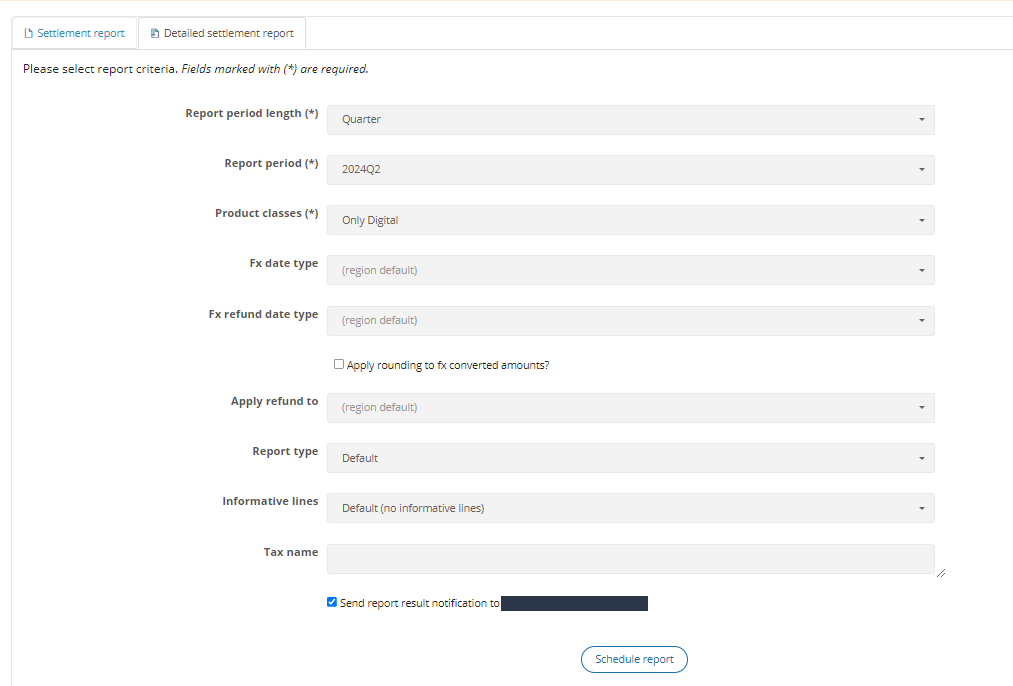

After you have chosen you filters, click Schedule report to run it:

Detailed Settlement report

Filters

The following filters are available. Mandatory filters are denoted by an asterisk:

| Filter | Description |

|---|---|

| Report Period Length* | Set the filter for the length of the time period that is reported on. |

| Report Period* | Set the filter for a specific period. |

| Product Classes* | Filter for a specific product class, such as digital or physical. |

| FX Date Type | This filters for a specific date type. This can be either Order date, Day before order date or Last from the selected range. |

| FX Refund Date Type | This filters for a specific date type for refunds. This can be either Order date, Day before order date or Last from the selected range. |

| Apply rounding to fx converted amounts? | If selected this checkbox means that amounts that are subject to currency conversion will be rounded to 2 decimal places. |

| Apply Refund To | Filter for refunds by the transaction's order date or the refund date. |

| Report Type | This is always Default. |

| Informative Lines | By default, no informative lines are included. You can choose to include them or you can include only informative transactions, excluding the non-informative. |

| Tax Name | This is a free text filter that allows you to filter for a specified tax by name. |

| Send report to user mail | Select this checkbox to send the report to your user's email. |

Country Specific Filters

The following table lists some country specific filters:

| Filter | Description |

|---|---|

| States | Filter for specific States in the United States of America (USA). |

Output Fields

The following are the fields that can be found in the Detailed settlement report.

| Report Field Name | Details | Description |

|---|---|---|

| Transaction type | n/a. This is generated by the service and returned in the response so it is not transformed. | This is the type of transaction a sale or a refund. |

| Exchange rate | API Field: API Data Type: float Report Date Type: String | The exchange rate that was used in the transaction, if any. |

| Exchange rate date | API Field: API Data Type: String Report Date Type: String | The date on which the used exchange rate was retrieved. |

| F/X source | API Field: API Data Type: String Report Date Type: String | The source, such as the ECB, that provided the exchange rate. |

| Currency code | API Field: API Data Type: String Report Date Type: String | The currency used for the transaction. |

| Target currency code | API Field: API Data Type: String Report Date Type: String | The currency used by this report. |

| Key | API Field: API Data Type: String Report Date Type: String | Unique transaction key generated by the service initially and use to identify the transaction later. |

| Country code | API Field: API Data Type: String Report Date Type: String | Country code of the country where liability resides. |

| Tax country name | API Field: API Data Type: String Report Date Type: String | Full name of the country where liability resides. |

| Tax deducted | API Field: API Data Type: Boolean Report Date Type: Boolean | Indicates whether tax was deducted. |

| Amount | API Field: API Data Type: Float Report Date Type: String | This the tax exclusive amount. |

| FX converted amount | n/a. This field is calculated when the report is run so it is not transformed. | The tax exclusive amount in the report currency. |

| Tax amount | API Field: API Data Type: Float Report Date Type: String | The amount of tax applied to a transaction line. |

| FX converted tax amount | n/a. This field is calculated when the report is run so it is not transformed. | Tax amount of the transaction in the tax reporting currency. |

| Tax rate | API Field: API Data Type: Float Report Date Type: String | Tax rate that was used for the transaction. |

| Total amount | API Field: API Data Type: Float Report Date Type: String | Amount plus the tax amount equals to the total amount. |

| FX converted total amount | API Field: API Data Type: Float Report Date Type: String | Amount plus the tax amount equals to the total amount in the tax reporting currency. |

| Product type | API Field: API Data Type: String Report Date Type: String | The service's reference for the type of good that is being sold. |

| Custom id | API Field: API Data Type: String Report Date Type: String | This is an unique ID that you can include in the transaction line. |

| Order date | API Field: API Data Type: String Report Date Type: String | This is the date that the transaction was confirmed. This is the date used for the report period that you choose in the filter. |

| Refund date | API Field: API Data Type: String Report Date Type: String | The date the refund was issued. |

| Invoice number | API Field: API Data Type: String Report Date Type: String | Number of the invoice for the sale. |

| Postal code | API Field: API Data Type: String Report Date Type: String | The postal or ZIP code of the customer. |

| Region | API Field: API Data Type: String Report Date Type: String | The region or state of the customer. |

| Sub account id | API Field: API Data Type: Integer Report Date Type: Integer | For Taxamo Assure users, this is a unique ID referring to your business. |

| External unique id | API Field: API Data Type: String Report Date Type: String | A unique ID reference to your business. |

| Product class | API Field: API Data Type: String Report Date Type: String | This is the type of product that you are selling either digital or physical. |

| Line Invoice number | API Field: API Data Type: Integer Report Date Type: Integer | Invoice line item, this is in the case where you could be selling 2 different products and they could have different tax rates/treatment and Vertex could issue multi-invoices. |

| Line Tax Country name | n/a. This field is present if 2 countries are liable for the tax in the transaction. In such a case, this field contains the information about the second country. | Tax country for the line item, this is in the case where you could be selling 2 different products and they could have different tax rates/treatment. |

US Fields

The following fields are provided for the USA:

| Field | API Field | Description |

|---|---|---|

| Tax component tax name | API Field: API Data Type: String Report Date Type: String | Type of sales tax, it can be STATE SALES TAX, COUNTY SALES TAX, DISTRICT TAX, CITY SALES TAX ,SPECIAL LOCAL - CAPITAL PROJECTS or SPECIAL LOCAL - EDUCATION CAPITAL IMPROVEMENT. |

| Tax component tax amount | API Field: API Data Type: String Report Date Type: String | Amount of sales tax on the transaction. |

| Tax component tax rate | API Field: API Data Type: String Report Date Type: String | The rate of sales tax. |

| Tax component jurisdiction code | n/a. This field is generated by the Tax Engine so is not transformed. | Code of the taxing jurisdiction. |

| Tax component tax authority ID | n/a. This field is generated by the Tax Engine so is not transformed. | Tax authority ID. |

| Tax component tax authority name | n/a. This field is generated by the Tax Engine so is not transformed. | Tax authority name. |

| Product code | API Field: API Data Type: String Report Date Type: String | The reference code used to identify products for US-based transactions. |

API Integration

The following requests are provided so you can use the API to retrieve the results if you prefer:

- You can use the List Detailed Settlement Reports request to list the reports for a specified period.

- Then, you can use the Download Link for Detailed Settlement Report request to download the report.

Automatic Scheduling

If you want, you can configure the detailed settlement report to run automatically at scheduled times. If you want to use this feature, contact Vertex to set it up.

For automated reports, the service creates an event in the report.complete webhook to notify you when it is complete. For more information about how to create a Webhook, see Vertex Webhooks.

Updated 30 days ago