Features

Get an overview of the features of the services.

Overview

The following table lists an overview of the features:

| Feature | Vertex for e-Commerce | Taxamo Assure |

|---|---|---|

| Tax calculation | X | X |

| Location determination | X | X |

| Threshold monitoring | X | |

| Tax ID validation | X | X |

| Foreign exchange management | X | X |

| Invoices | X | X |

| VAT/GST liability shifts to Taxamo. | X |

Common Features

The following features are shared by Taxamo Assure and Vertex for e-Commerce:

Customer Location Determination

Countries have different requirements on how to determine whether a transaction should fall under local tax laws or not. The key point to consider is where the customer of the electronic service is located, or in some cases, where they are typically located.

Some countries require the collection of two pieces of non-conflicting evidence while others only require one. Vertex has developed a real-time tax logic algorithm and evidence hierarchy that manages the effective allocation of the correct tax treatment for every transaction.

The country of the customer must be determined by several pieces of evidence. The types of evidence that Vertex uses can include the following:

- IP address

- Billing country code

- Payment country (can be derived from the credit card BIN)

- Payment method country (PayPal user country) and IBAN country

- VAT/GST registration numbers

- Self-declaration

- Other commercially relevant information

Business-to-Business (B2B) Transactions and Tax ID Validation

Where there is a sale to a business customer, the sale may be exempt from tax. This is known as a Business-to-Business (B2B) transaction. For example, where there is a sale for resale to a business customer the sale may be exempt from sales tax. Vertex supports this kind of transaction. In addition, a tax ID validation service is provided that you can use to verify your customers' tax IDs.

When tax is not charged to a business customer, such customers will apply what is called reverse charge. To ensure that a transaction qualifies as a reverse charge, the business customer must typically provide a tax ID number issued by their local tax authority to confirm that they are registered for tax. This number is validated using the service's API.

Depending on the country, the service will either validate the number against a local database or check the syntax of the number that is provided, as directed by local requirements.

For some countries, there is an additional requirement of having a self-declaration message that states something similar to: “By inputting your VAT/GST number you confirm that you are a VAT/GST registered customer and you will account for VAT/GST.”

For certain countries, where VAT/GST is charged on B2B transactions, there is also the option to request that the VAT/GST number is displayed on the invoice. The message will be similar to: “Please add your VAT number so it displays on the invoice.”

See Vertex Validator.

Tax Inclusive and Exclusive Pricing

The service provides a pricing option to display pricing with or without tax, these options are called universal (tax inclusive) and dynamic pricing (tax exclusive).

With Universal pricing, the merchant can keep the price of their digital goods the same across all countries and include the tax in the price. In this case, the tax inclusive amount can be sent using the total_amount field in the API. The service will calculate the tax and return the tax exclusive amount (amount field), amount of tax (tax_amount field), and the tax inclusive amount (total_amount field).

Information

The default behavior for B2B transactions is different from Business-to-Customer (B2C). When universal pricing is enabled, the B2B transaction will recalculate the

total_amountfield to remove the amount of tax that would have been charged if the transaction had been B2C. This behavior can be overridden via an account setting, if preferred, so that B2B transactions can also have Universal pricing.

Dynamic pricing is where the merchant can price per individual country. They are adding the tax amount to their list price. Where the pricing is dynamic, the amount is sent to Vertex and the tax_amount is added to this to give the total_amount.

Subscription Lifecycle Management

For recurring transactions, a placeholder transaction can be created in the service. This provides the evidence to determine the customer's country so the VAT/GST and the US sales tax rate can be determined for the initial and subsequent transactions. When subsequent transactions occur, the placeholder transaction ID can be provided to Vertex so that the evidence from the initial transaction is used.

If the subscription is updated and there is a change of evidence, for example customer country/VAT number has changed, this information needs to be provided to Vertex to update the tax calculation.

If there are upgrades or downgrades, Vertex needs to be notified of the revised charge amount where applicable. These changes are then reflected in appropriate filings and tax reports.

Invoicing

The service allows you to take advantage of the in-built invoicing features.

The service's invoicing module is an optional feature that helps you to meet certain compliance regulations in all countries that we support. For example, India and Belarus require a digital signature to be displayed on every invoice, and in Saudi Arabia the invoice to the end customer must be in Arabic.

See Vertex Invoice IQ.

Enable Global Sales

The service can help you pay the required VAT or GST tax for your digital sales and meet the requirements of customers in the supported countries and regions.

The integration with your checkout processes ensure that your sales are compliant, without disrupting your customers' experiences.

Taxamo Assure Features

The following features are exclusive to Taxamo Assure:

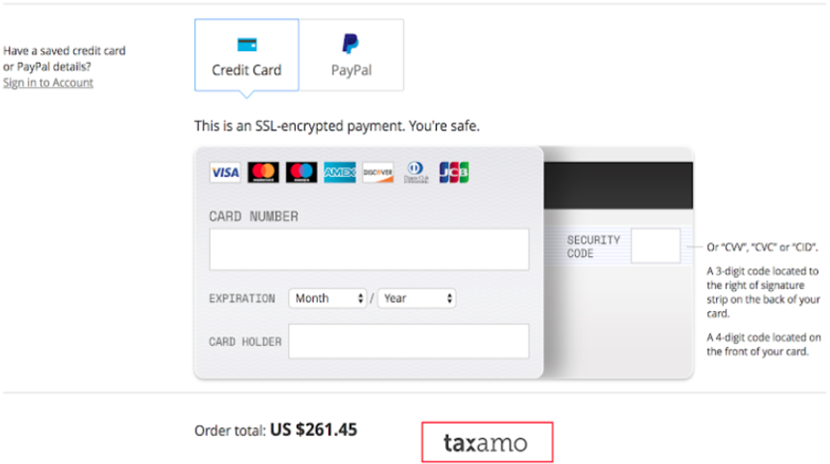

Invoice and Logo Integration

The Taxamo logo needs to be displayed on the checkout page because of the tax liability they bear. This is required for tax compliance.

The logo is displayed on the checkout UI and on invoices sent by Taxamo. The following figure shows an example of the logo integrated into a checkout UI:

Logo Displayed on Checkout

Manage Foreign Exchange Exposure

Payment of your tax obligations helps you to manage your exposure to foreign exchange rate risks.

Vertex for e-Commerce

The following feature is exclusive to Vertex for e-Commerce:

Threshold Monitoring

See Threshold Monitoring.

Vertex Advantage Plus

Vertex Validator

See Vertex Validator.

Vertex Invoice IQ

See Vertex Invoice IQ.

Updated 10 months ago