Standalone Vertex Validator

Read about how you can deploy Vertex Validator independently of the other products.

Overview

One of the options for using Vertex Validator is as a standalone component. This is where you solely use Vertex Validator and do not use Vertex for e-Commerce or other products. For example, some customers may want to integrate supplier verification into their supplier onboarding process.

To facilitate this type of integration, you use the Validate VAT number request.

You can also use the Bulk Tax ID Validations feature to validate a batch of IDs.

Version 3 Documentation

This documentation is for Version 2 of Vertex Validator.

The documentation for the most recent version of this service, Version 3, is available here, as a standalone version of Vertex Validator.

UI and Access Tokens

You need to contact support to get a user before you can integrate with the service. After you get this user, log in to the Merchant Portal and retrieve your access token. You will need this to be able to make requests. You can also later change settings in the UI if needed. See Retrieving Access Tokens.

Restrictions

You can only validate one Tax ID per Validate VAT number request.

Prerequisite Settings

You need to enable the Tax calculation setting in the UI for each region whos Tax IDs you want to validate. See Country Settings.

API Integration

To integrate the service, you use the Validate VAT number request. See Validate VAT number.

To use this request, send a GET operation to the following endpoint URL:

https://services.taxamo.com/api/v2/tax/vat_numbers/{tax-number}/validate?{country_code}

where:

{tax-number}is the Tax ID that you want to verify.{country_code}is the country where the ID originates.

The following table lists the parameters that you can include with the the request:

| Parameter | Description |

|---|---|

private_token | Private token. |

tax_number | The Tax ID that you wish to validate. |

country_code | The code for the country. Note that for some Canadian provinces like Quebec, you must prefix the number with CA. |

Configuring CAPTCHA Validation

Some countries require additional validation such as CAPTCHAs. See Configuring CAPTCHA Validation.

Process Flow

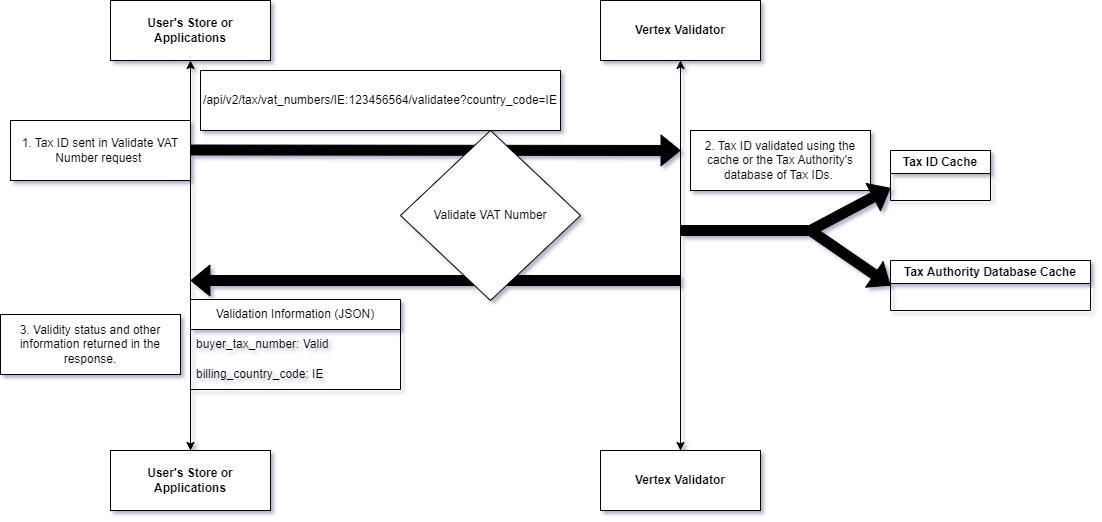

The following diagram shows a typical process flow for a standalone integration:

Standalone Validator Processing

The steps are as follows:

- A Tax ID is sent to the service for validation. It is specified in the URL of a Validate VAT Number request.

- The service validates the Tax ID, using the cache of previously approved IDs or the Tax Authority's database. This depends on your settings. See VAT Status Cache.

- The request's response contains information about whether the ID is valid and some other useful information. See Vertex Validator Output Schema.

Post Transaction Processing

Useful validation information is returned by the API. See Vertex Validator Output Schema.

In some cases, this information can be redacted. See Redacted Responses.

Updated about 2 months ago