Invoicing Overview

Taxamo’s compliance team is regularly monitoring changes worldwide made by countries to their VAT/GST regulations.

Whenever Taxamo determines that it is necessary to provide support in our system for an additional country, there is an extensive process undertaken to determine the laws and regulations that we must adhere to in order to operate compliantly in that country.

One of the primary areas that we focus on in this process are the regulations around invoicing. While on the surface invoices might appear mostly the same from one country to the next, nearly every country puts into law specific invoicing requirements. There are subtle, but important, differences that vary from one country to the next.

Some of these country-specific regulations may include:

- Specifying the exact wording in the title of the invoice

- Sequential numbering

- Displaying amounts in the local currency along with an exchange rate

- Issuing the invoice in the local language

- Providing a signature of the supplier or the authorised representative

- Displaying the accounting code of the service you are selling

- Displaying a reverse charge message for B2B sales

Our invoicing solution provides you with the following options for delivery of the invoice:

- Emailing the customer a link to the invoice (the link can be to either an HTML page or a PDF download).

- Embedding the invoice content into the body of an email to the customer

- The invoice (PDF or HTML) can be pulled into your system so that it can be accessed by customers after they have authenticated on your site. In most cases, this is Taxamo’s recommended option.

Within the Taxamo Merchant Portal there are a number of configuration settings for invoices in Settings > Invoicing.

Settings

Rules for the creation and delivery of invoices are set on the Settings > Invoicing > Invoicing rules screen, as shown here with explanations for each of the settings:

Invoice Settings

Sample invoices

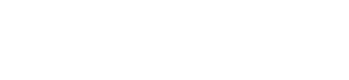

Here is an Advantage invoice. This is a US Dollar (USD) transaction, with the customer currency detected as euro (EUR).

Advantage invoice

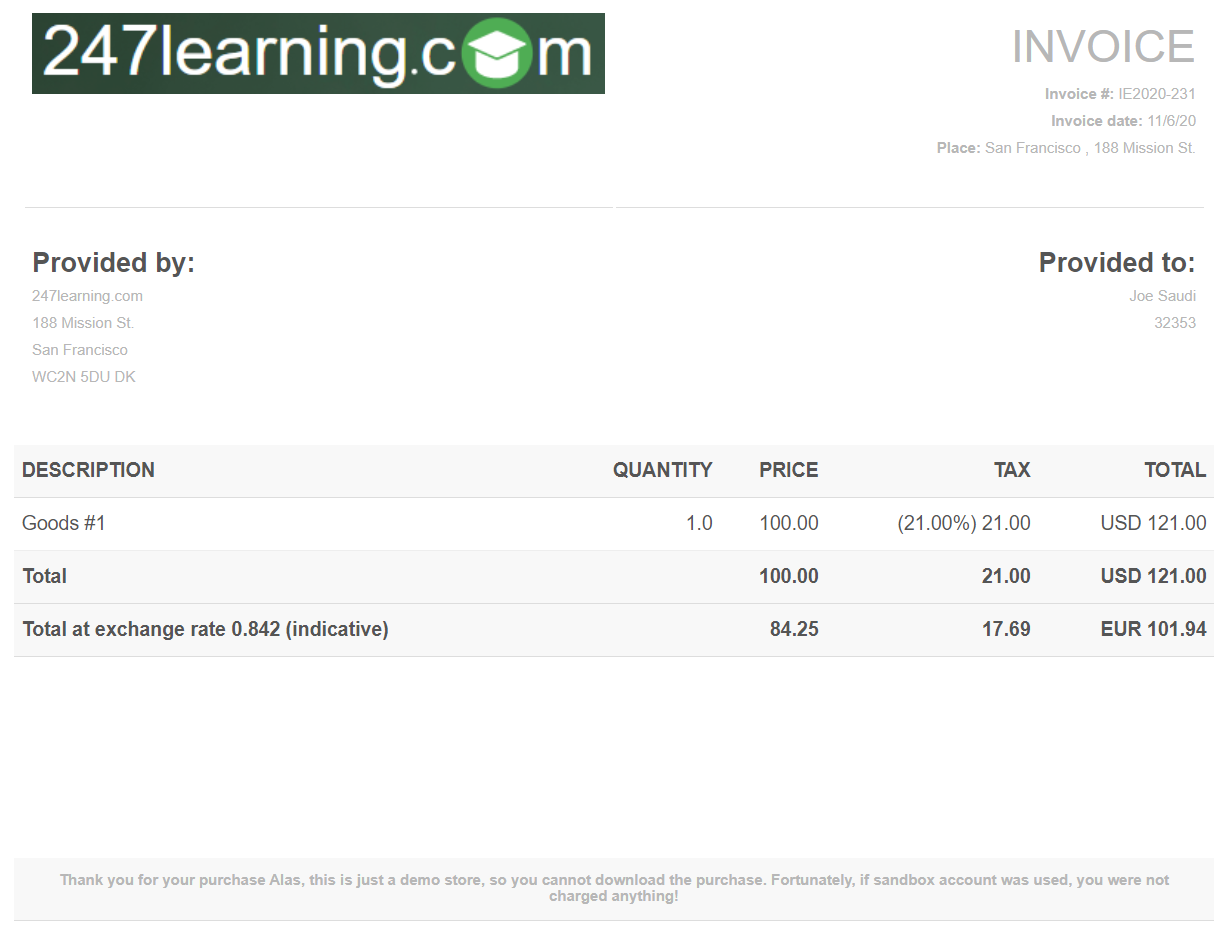

Assure invoice

Here is an Assure invoice. This is a US Dollar (USD) transaction, with the customer currency detected as Indian Rupee (INR). Note that the use of the Taxamo logo and additional text on the footer of the invoice.

Invoicing rules settings

Any changes you make here will apply to both TEST and LIVE modes, unless there are separate settings for TEST and LIVE mode. You will find a list of all of the settings which can be customized below:

SMTP Configuration

Invoices will be delivered using custom SMTP server settings. Credentials are entered in the dashboard in the fields provided for test and live mode.

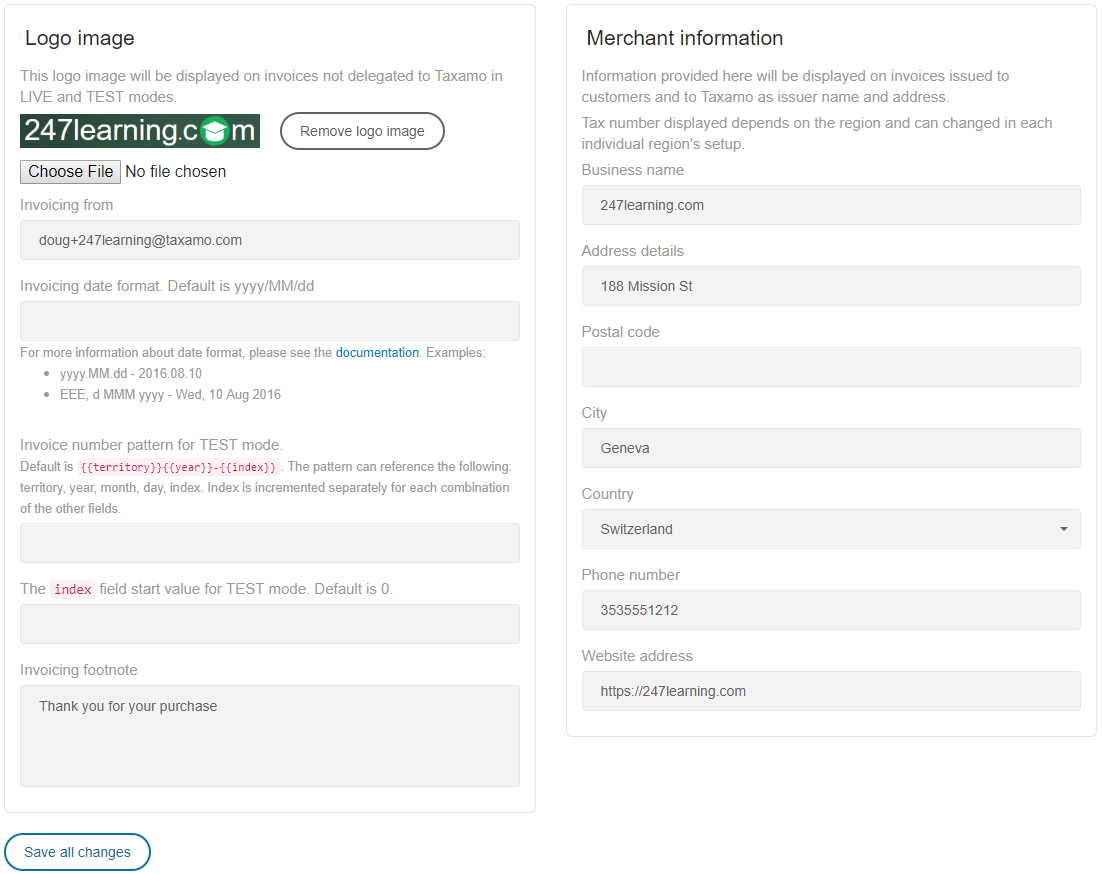

Invoicing template settings

Customisation of an invoice is available by configuring the following options.

- Logo: Upload your own logo to appear on the invoice.

- Invoice email from: The invoice email will show as coming from this address. This can be set to the relevant merchant email address.

- Invoice number pattern: Customize the pattern of the invoice numbering. There are separate fields for Live and for Test modes.

- Start value: The initial value to begin your invoice numbering. There are separate fields for Live and for Test modes.

- Footnote: This area can be updated with any detail that the merchant would like to add to the invoice, for example, their terms and conditions.

Invoice data

The data that populates the invoice includes merchant and transaction information.

For manual transactions the data is within the Taxamo Merchant Portal under the following tabs:

- Invoice number: This can be provided by the merchant, or it can be generated by Taxamo. Taxamo will generate a number that complies with international regulations, including EU rules that require sequential invoice numbers per country.

- From address: Merchant details in the My account > Billing details section.

- To address: Customer details from the ‘Invoice data’ tab. This can be found by going to 'Transactions' on the left-hand navigation bar in the Taxamo dashboard, and by clicking into the relevant transaction. After clicking on a transaction, 'Invoice data' is the third available tab.

- Invoice date: From ‘Invoice data’ tab. As above.

- Supply date ‘place’: It shows the place of the supply.

- Line items: ‘Order details’ tab. This can be found by going to ‘Transactions’ and clicking into the relevant transaction. After clicking on a transaction the ‘Invoice data’ is the first available tab.

- Email address: The customer email address is taken from the ‘Additional info’ tab. Again, click on ‘Transactions’ and view the required transaction. ‘Additional info’ is the fourth available tab. This is the email address that will receive details of the link to the invoice.

The invoice logo can be uploaded via the dashboard, and custom messages or links can be added to the invoice footer.

Invoice email

An email is sent to the address supplied.

The contents of the email are as follows:

Hello [customer name],

An invoice has been prepared for your purchase.

Please click on the following link to see your invoice: [html link to invoice will be included here] or download a PDF version here: [PDF link to invoice will be included here]

Best regards,

[Merchant details here]

If using Taxamo's subscription support, transactions are automatically created each time a renewal occurs.

If you have invoicing and auto-delivery enabled, invoices will be generated and sent to the customer automatically.

Other invoicing settings also apply to recurring payments. For example, if there is a discount on a recurring payment and the amount for that billing period is 0, the invoice will not be generated if the 'issue invoices for zero amount transactions' is disabled.

Also, there is an option to disable invoices for the placeholder transaction of a subscription.

Updated about 3 years ago